L I F E S T Y L E

Focus

Sunday November 5, 2006

One man’s war on poverty

An unassuming economics professor JUNE H. L. WONG interviewed more than a decade ago suddenly becomes very famous when he wins the most prestigious prize in the world.

ELEVEN years ago, I was privileged to meet a man whose mission was to wipe out poverty from the face of the earth. It seemed very quixotic but he believed he had a way of doing it: Lending very small amounts of money to the very poor to give them a head start in making a living. He called such lending, micro-credit.

This man was Bangladeshi economics professor-turned-banker Dr Muhammad Yunus. After that meeting, I kept track, in a rather desultory way, of this gentle, unassuming man, as he increasingly won international attention and recognition for his work.

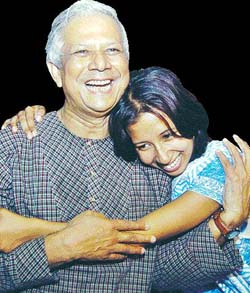

Dr Muhammad Yunus – in his trademark kurta – celebrating news of his Nobel Prize win with daughter Dina in Dhaka on Oct 13. He will use his share of the US$1.4mil (RM5.18mil) award money to set up a company to make low-cost, high-nutrition food and an eye hospital for the poor in Bangladesh.

Finally, on Oct 13, he received the most prestigious recognition of all: The Nobel Peace Prize. I was elated when the Norwegian Nobel Committee decided to “award the Nobel Peace Prize for 2006, divided into two equal parts, to Muhammad Yunus and Grameen Bank for their efforts to create economic and social development from below.”

News of the award brought back memories of my meeting with him in Beijing in September 1995, during the United Nations World Conference on Women.

I had never heard of Dr Yunus before but after hearing him speak about his work and seeing how he won over the likes of World Bank officials and then US First Lady Hillary Clinton, who was also at the conference, I was determined to interview him.

We met in the lobby of a Beijing hotel and we spent a good two hours talking about his work.

Grameen Bank borrower, Banesa Khatun – with son Anis Mia (right) and daughter Seema Khatun – says that when the scheme was introduced in her country, Bangladesh, 30 years ago, it helped lift her from among the poorest of the poor to a respectable, independent woman.

When I returned to Malaysia, I wrote my report and published it in The Star on Oct 27, 1995, to mark International Day for the Eradication of Poverty.

My story on how Dr Yunus, 65, started is now an old one, repeated in countless interviews around the world since he began drawing international attention. This is what I wrote in 1995:

The son of a jeweller in Chittagong, the south-east port of Bangladesh, Dr Yunus earned his basic degree and Masters from Dhaka University. He then won a Fulbright Scholarship to do his doctorate at Vanderbilt University at Nashville, Tennessee, in 1965. He stayed on to take up a teaching position in 1969.

Three years later in 1971, after a bloody civil war, Bangladesh became an independent state. The economy was devastated but there was great hope for rebuilding.

Dr Yunus, eager to help, returned home and joined Chittagong University as head of the Economics Department.

“But then there was a terrible famine in 1974 that killed many people. I felt empty teaching my students beautiful and elegant theories that had nothing to do with the lives of the people.

“I decided I wanted to find why out why people couldn’t find enough food to eat and how to resolve their problems,” he said.

It wasn’t hard since his university was surrounded by poor villages. He visited them every day and began to understand the desperate lives of poor peasants.

“I saw how people suffered for a tiny amount of money because they had to borrow from loan sharks.”

Within two weeks, Dr Yunus compiled a list of 42 people from one village who had taken such loans.

“All they needed was US$30 (RM75). My first response was to give the money to them from my own pocket so that they could pay off the moneylender. I made no conditions.”

In the El Salvadorean city of San Marcos, 51-year-old Nolberta Melara saw her life transformed through a US$30 loan from the Support for the Microbusiness Centre, an NGO based on the Grameen Bank. Melara sews aprons and sells them in markets across the country.

But Dr Yunus soon realised that it couldn’t just end there. “I realised they wouldn’t be able to find me in the university if they needed more loans so I approached the campus branch of a local bank and asked the manager to lend money to villagers.

“He thought I was joking because the bank didn’t give one dollar loans and certainly not to poor people.”

And that was the start of Dr Yunus’ one-man crusade to show that banking on the poor could change their lives for the better and at the same time be profitable for financial institutions.

It took him six years to sign up 200,000 borrowers with a repayment rate of 98%. But bankers remained sceptical, saying that his was a small-scale venture that would not survive if it got any bigger.

It was then Dr Yunus decided to set up his own bank, to be called the Grameen Bank (grameen means “rural”), in 1983 with the support of Bangladesh’s central bank.

Egyptian vegetable vendor Hanem Shaban got her first Grameen Bank-type loan of 250 Egyptian pounds (RM159) six years ago and expanded her vegetable stall in Cairo’s popular Imbaba market. She now earns much more money than before.

Today, according to the Grameen Bank website, as of May, it has 6.67 million borrowers, 97 % of whom are women (see ‘Working wonders with women’). With 2,247 branches, it provides services in 72,096 villages, covering more than 86% of the total number of villages in Bangladesh.

Micro financing has also spread beyond Bangladesh to other parts of the world. Locally, Amanah Ikhtiar Malaysia (AIM), set up in 1987, was among the earliest replications of the Grameen model.

(AIM has 69 branches with 157,000 active members nationwide and has provided loans amounting to RM1.7bil, mostly to finance business activities. It received a boost recently when Prime Minister Datuk Seri Abdullah Badawi announced an additional allocation of RM100mil to its coffers.)

I was not the only journalist who took delight in Dr Yunus’s Nobel Prize win. NBC news correspondent Mark Potter posted the following in The Daily Nightly, a blog written by MCNBC journos and producers:

“I had to smile this morning when I read that Bangladeshi economist Muhammad Yunus and his Grameen Bank won the Nobel Peace Prize. Yunus ? was the inspiration for a man we featured earlier this year on a Nightly News ‘Making a Difference’ piece from the island of Samoa, in the South Pacific.

“What might appear to be dry economic and social theory on paper is actually deeply moving when you see it in practice and witness the results – as we were lucky enough to do this spring.

“Our story featured Greg Casagrande, who was a hard-charging executive for Ford and Mazda before he gave it all up to chase his dream of eradicating poverty. After studying Yunus’ principles, he used his own money to start up a loan program for women in impoverished Samoa.”

This is but one inspiring example of how the Grameen model has been copied successfully all over the world.

But Grameen is not without critics, as CNews journalist Farid Hossain pointed out.

The criticisms have focused on the bank’s high interest rates, which, at 20%, are significantly higher than the 10%-15% charged by commercial banks.

“While the poor pay 20% interest for their loan, the rich pay much less. It can’t be called social justice,” Farid quoted S.M. Akash, an economics professor at Dhaka University, as saying.

Dr Yunus’ response, according to journalist Alan Jolis whose The Independent on Sunday article appears in grameen-info.org : If anyone can run a bank for the poor and charge less, please go ahead and do so.

Polio victim S. Thilagavathy (with AIM manager Zubairi Mohd Fadzil and her daughter Reena Devi) earned RM50 by offering sewing services. She was able to increase her earnings to RM350 after receiving a loan from AIM in 2000 to buy a sewing machine.

Despite such criticisms, Dr Yunus is considered a national hero in his country even before he won the Nobel Prize. Indeed, unlike many previous Nobel Peace Prize winners, he is seen as a most deserving recipient and a popular choice among ordinary folk.

A person who responded to Potter’s posting in The Daily Nightly wondered why Dr Yunus didn’t win the prize for economics. The Norwegian Nobel Committee answered that question best when it explained its decision:

“Lasting peace cannot be achieved unless large population groups find ways in which to break out of poverty. Micro-credit is one such means. Development from below also serves to advance democracy and human rights.”

To underscore that statement, it’s worthwhile to quote what Dr Yunus told Jolis: “Poverty covers people in a thick crust and makes the poor appear stupid and without initiative.

“Yet if you give them credit, they will slowly come back to life. Even those who seemingly have no conceptual thought, no ability to think of yesterday or tomorrow, are in fact quite intelligent and expert at the art of survival. Credit is the key that unlocks their humanity.”

In 1995, he told me that his mission was to show that a poverty-free world is possible in our lifetime and his goal was to provide credit to the world’s 100 million poorest families through women by 2005.

According to the 2005 State of Microcredit Summit Campaign Report, as of Dec 31, 2004, some 3,200 micro-credit institutions reported reaching more than 92 million clients. Almost 73% of them were living in dire poverty at the time of their first loan.

That would mean Dr Yunus has reached his goal and he may see his ultimate dream realised.

He said to me: “How wonderful if, one day, our grandchildren must visit a museum to see what poverty was all about.”

I concluded my story then by saying: “Wishful thinking?” I won’t make the same mistake twice.

Kinokuniya Bookstores is offering Dr Muhammad Yunus’ critically acclaimed book, ‘Banker to the Poor: Micro-credit and the Battle Against World Poverty’ (ISBN: 1-586-48198-3) at a 25% discount. However, stocks have run out and the book will only be available at Kinokuniya’s Suria KLCC store after Dec 1. The discount is valid between Dec 1 and Dec 31 (or while stocks last).

No comments:

Post a Comment